Simplify Tax Time

TaxCaddy will simplify your role in the gathering and delivery part of the tax preparation process. This year, we’re using TaxCaddy to simplify how we request and receive documents, data, and signatures from you. Your official TaxCaddy invitation will arrive via email.

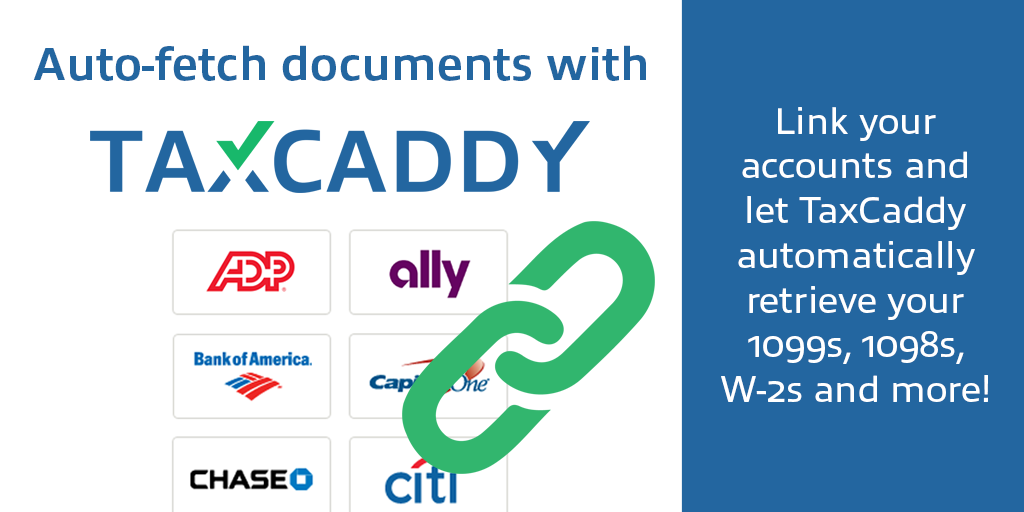

TaxCaddy makes gathering tax documents and sharing them with your tax advisor a breeze. Let TaxCaddy retrieve your 1099s, 1098s, and W-2s automatically. Upload or snap photos of your tax documents year-round and store them with bank vault security. Electronically sign your tax documents from anywhere. Pay your invoice. Make your Federal and State tax payments right from TaxCaddy.

SAVE TIME

Easy information and document upload.

Easy to use

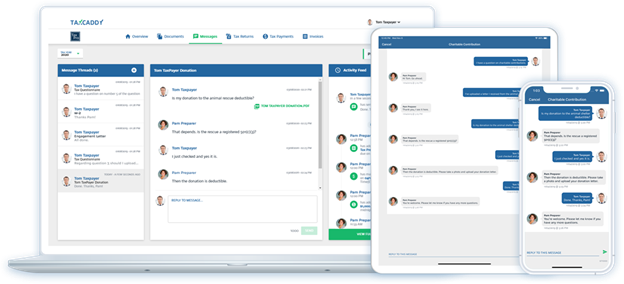

TaxCaddy’s application can be used on any device.

Reduces Stress

Easy communication with your tax advisor.

Any device

PC, Mac, tablet, mobile phone

Respond to a document request on your office PC. Use the mobile app to ask your tax professional a question while you’re waiting to board your flight. View and approve your tax return on your tablet from the comfort of your couch. TaxCaddy enables you to collaborate, share, and communicate with your tax professional from anywhere—on any device.

TaxCaddy How To

How to view the documents your tax advisor has requested.

How to complete your questionnaire.

How to auto-fetch your tax documents from your financial institutions.

How to upload your documents.

How to message your tax advisor.

How to e-sign documents.

TaxCaddy Support

Many resources, such as visual tutorials and support staff, are provided at TaxCaddy’s Help Center.

If you need additional help, you can:

- Live chat with TaxCaddy Support (During Support Hours)

- Submit a ticket from TaxCaddy

- Submit a ticket from Help Center

- Email [email protected]

- Call 1-833-TaxDesk or 1-833-829-3375

Support hours are from 10 a.m. to 8 p.m. EST, Monday through Friday, excluding holidays. The typical turnaround time for support tickets is 24 hours. Note: TaxCaddy is unable to provide phone support.