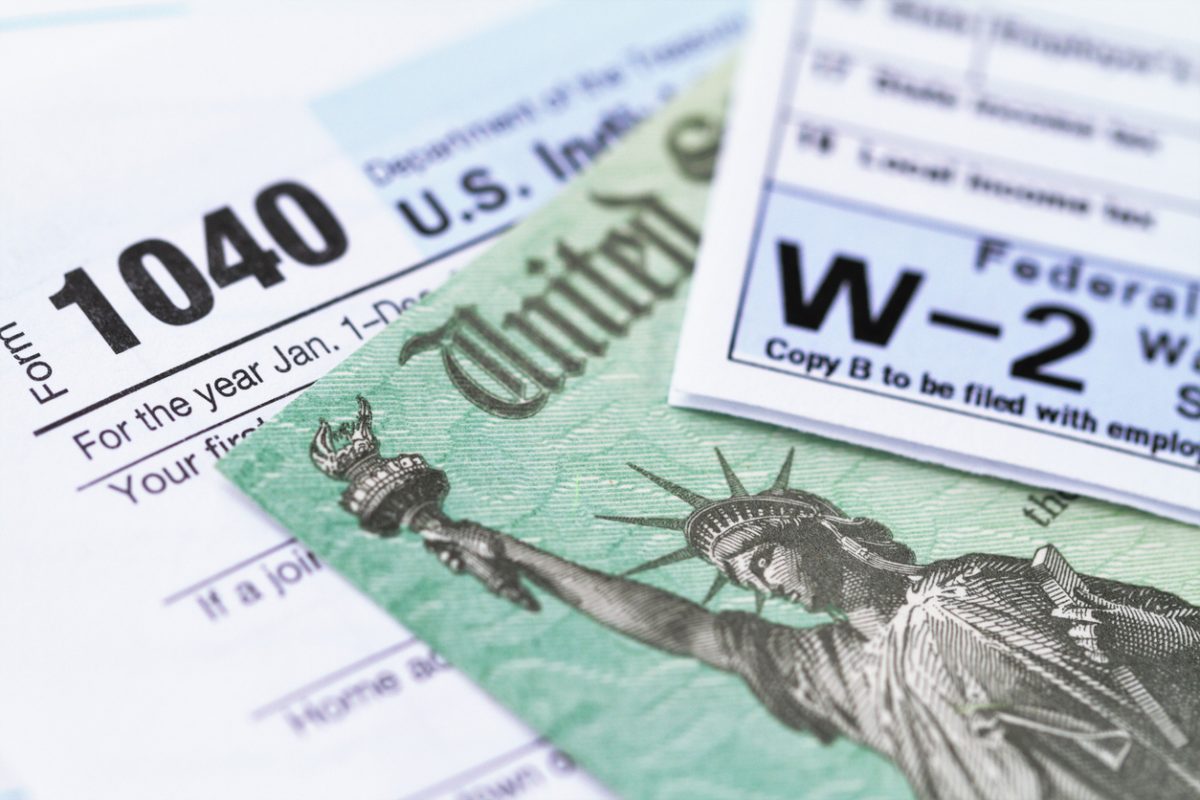

Tax Preparation Process

Professional Tax Services

At Taylor & Company, we’re not interested in being just a once-a-year dump and prep professional tax service. Sure, compliance of filing accurate and timely tax returns is a given, but our mission is to provide you with actionable tax planning services and strategies you can use in the real world to lower your tax liability.

Every relationship starts with a complete review of your prior year tax returns. We often find that many new clients have not captured all the deductions they could, such as depreciating a rental property or netting bond premium and accrued interest against taxable bond interest. In this case we will amend those tax returns and generate refunds.

We are passionate about taxes and use our deep knowledge of tax law to keep you in compliance while taking advantage of every tax credit and deduction. Tax returns are required to be prepared and filed every year, but so many overlook credits and deductions because they do know they exist. So, if you are looking for experienced and passionate tax advisors who look out for you and your family’s best interests, then get started with Taylor and Company.

Other than being experts in tax law, when considering us for your tax preparation needs, there are several reasons our clients know we have their best interest in mind and that distinguishes us from other preparers.

- We will return a call or email within 24 hours

- We will provide you with current and future tax planning that incorporates current tax strategies

- We will use technology to your advantage to ensure you have an efficient tax preparation process

Connect with a CPA

Meet with us at our office in Baltimore County, or we can serve as your virtual tax preparer.