US Markets Stock overcame recession worries and mixed corporate earnings results in April, ending mostly…

Monthly Market Insights | February 2023

US Markets

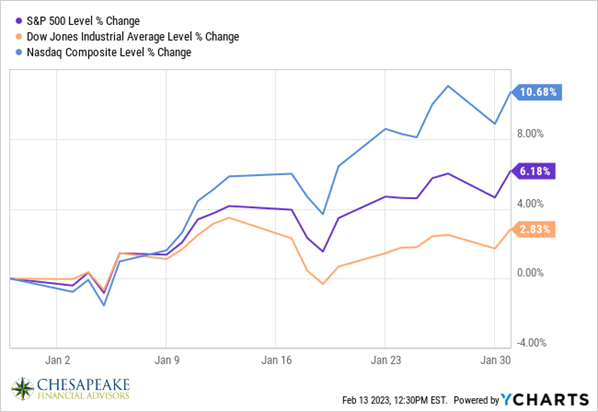

Stocks rallied in January as moderating inflation, a better-than-feared earnings season, and healthy economic data put investors in a buying mood.

For the month, The Dow Jones Industrial Average rose 2.83%. The Standard & Poors 500 Index jumped by 6.18% and the Nasdaq Composite rose 10.68%.

Shift in Sentiment

The stock market opened the new year the way it ended the previous year, moving lower with high-growth names bearing the brunt of selling. Particularly troublesome to investors was the continued strength of the labor market, which heightened the worries that the Fed would hike rates higher for longer to bring inflation to its target rate of 2.0%.

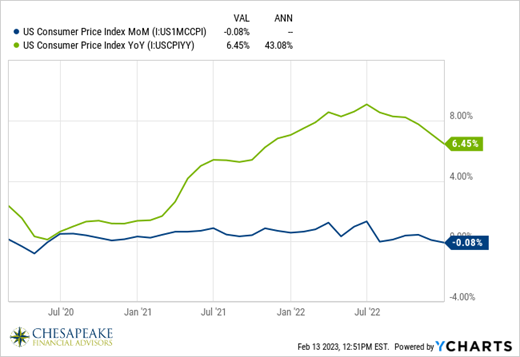

But market sentiment took a sharp -U-turn after another cooling consumer inflation number reinforced the disinflationary trend of the last six months. Suddenly, investors appeared to adopt a different view of the future-one characterized by continued disinflation, a rate hike cycle nearing its end, and a fading probability of a near-term recession.

The Power of Earnings

Corporate earnings provided some much-needed support for the rally. Investors were looking for insights to gauge the state of the US economy through corporate reports and the guidance that management was offering on forward earnings prospects.

As of February 10th, 69% of the companies comprising the S&P 500 Index reporting, 69% reported earnings above Wall Street estimates, less than the five-year average of 77% but strong enough to bolster confidence.

A Winding Road Higher

The march toward higher stock prices did not follow a straight line. The month’s trading was choppy, with stretches that saw the resurfacing of recession fears and anxieties over future Fed rate hikes. For instance, stocks retreated midmonth on weak retail sales and manufacturing data that raised concerns that the Fed might have gone too far in raising rates.

As the month ended, stock wavered ahead of a busy week for earnings and the scheduled Fed meeting. But they regained their footing on the final day of trading to close out one of the strongest months in years.

Sector Scorecard

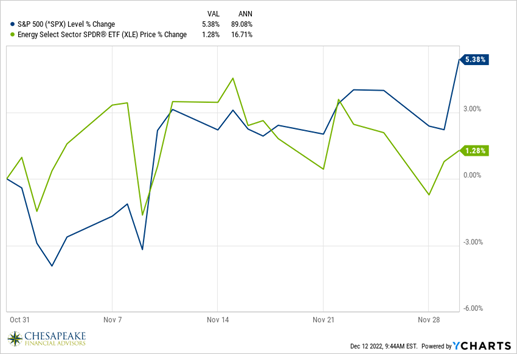

Most industry sectors ended higher in January, including Consumer Discretionary (+15.13%), Communications Services (+14.77%), Technology (+9.26%) showing more signs of a “risk on” mentality in the markets while sectors such as Health Care and Utilities were negative for the month. Oil prices continue to remain steady after small-than expected build in US crude inventories.”

What Investors May Be Talking About in February

In the month ahead, investors are expected to dig into the details of the January inflation report scheduled for release on February 14th.

Investors cheered when the December update showed that inflation dropped again, confirming a six-month downtrend.

While the cost of goods has dropped over that time, the cost of services has stubbornly remained high.

In gauging how the Fed is viewing inflation progress, investors may keep an eye on the labor market, a major contributor to service costs. The Fed has expressed that a tight labor market, with its attendant wage gains, places upward pressure on inflation.

Consequently, wage trend reports, including the monthly Employment Situation Summary and the Atlanta Fed’s monthly Wage Growth Tracker, along with the services inflation number, may become the real headlines going forward.

World Markets

Overseas markets continued to rally in January as the MSCI-EAFE Index picked up 8.11%. Mainly sparked by falling inflation, an improving economic outlook in Europe and the continued reopening of China.

Indicators

Gross Domestic Product (GDP)

The nation’s economy grew at a 2.9% annualized rate in the fourth quarter. This represented a slowdown from the 3.2% expansion in the third quarter, though it is a tick higher than the 2.8% consensus estimate by economists.

Employment

Employers added 223,000 jobs in December, while wage growth slowed to a 0.3% gain from the previous month 4.6% from a year ago. The unemployment rate fell to 3.5%.

Retail Sales

Retail sales fell by 1.1% in December, while November sales were revised downward. It was the second consecutive month of month-over-month declines and the largest contraction in a year.

Industrial Production

Industrial production declined by 0.7%, led by a 1.3% decline in manufacturing output. Output by the nation’s factories, mines and utilities fell by 1.7% on an annualized basis in the fourth quarter.

Housing

Housing starts dropped by 1.4% in December, though single-family housing starts rebounded by 11.3%.

Sales of existing homes fell for the 11th consecutive month, slipping by 1.5% in December. For the full year of 2022, sales declined by 17.8%, the weakest annual result since 2014.

New home sales rose by 2.3%, making it the third consecutive month of increases, though 2022 sales fell to their lowest level in four years.

Consumer Price Index (CPI)

The rise in consumer prices slowed for the sixth month straight, falling by 0.1% month over month and decelerating to a 6.5% increase from a year ago. Core prices (excluding food and energy) rose 5.7%, an easing from November’s 6.0% year-over-year jump.

Durable Goods Orders

Orders for long-lasting goods rose by 5.6% in December, well above the 2.4% forecast.

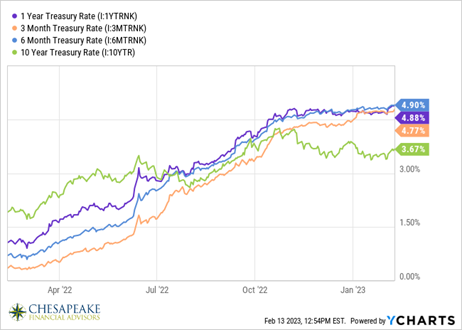

The Fed

Minutes from December’s meeting of the Federal Open Market Committee (FOMC) reflected concerns that investors’ hopes of near-term easing in short-term rate hikes could make the Fed’s job of combating inflation more difficult. These minutes also indicated that additional rate hikes are likely, at least through the spring, with any potential cuts not expected to occur until sometime in 2024.

Fed officials welcomed the recent cooling in monthly inflation numbers but would require more sustained progress before they felt confident that inflation was under control.

ONE ADVISOR | TWICE THE ADVICETM

Find out if you are on track for retirement, give us a call at (410) 823-5442 or email [email protected].

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf