US Markets Stock overcame recession worries and mixed corporate earnings results in April, ending mostly…

Monthly Market Insights | November 2022

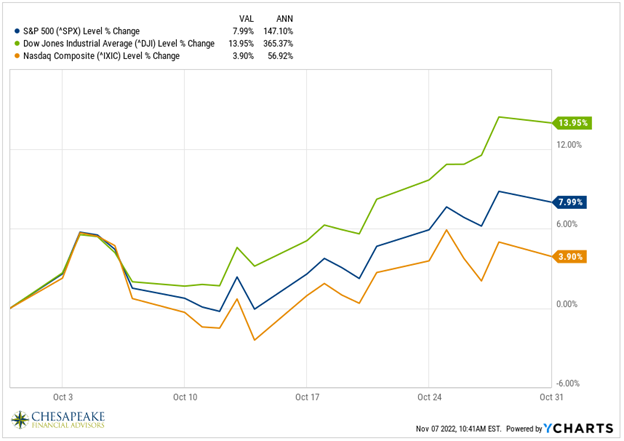

Stocks posted big gains in October, propelled by better-than-expected corporate reports.

The Dow Jones Industrial Average led, gaining 13.95%. The Standard & Poors 500 Index tacked on 7.99% and the Nasdaq Composite added 3.90%. We are beginning to see a transition from large-cap growth stocks to value stocks given current market conditions.

A Volatile Few Weeks

October opened with a powerful two-day rally, but the momentum faded as news reported that Britain’s prime minister had reversed her tax cut proposal helped spark the rally. The gains were erased on renewed fears of higher interest rates and possible recession in our future.

On October 12th, market volatility accelerated when a higher-than-expected consumer inflation number sent tumbling in early trading before inexplicably staging a massive reversal that saw the Dow Industrial rally 1,500 points from its intraday low.

Earnings Spark Rally

As earnings season opened mid-month, investors put aside worries about Fed policy and recession to focus on how companies fared in the third quarter.

By the end of October, 263 companies in the S&P 500 index had reported earnings and 73.4% had topped analysts’ estimates, well above the 66% long-term out performance quarterly average. Sales rose by 10.3% but much of that gain was attributed to the effects of inflation.

Value Shift?

Several mega-cap technology names reported disappointing earnings for the quarter and provided weak guidance for the months ahead. These companies struggled with declining advertising, poor expense management, and a deceleration in cloud-computing growth. The news surprised some investors and resulted in lower stock prices.

While the mega-caps struggled some “old economy” names reported quarterly numbers that were above expectations. For instance, in the industrials industry sector, 83% of companies reported earnings above expectations compared with the 73.4% average.

This divergence in third-quarter earnings between mega-cap tech and old economy “value” names contributed to the wide dispersion in performance between the Dow Industrials and Nasdaq Composite this month.

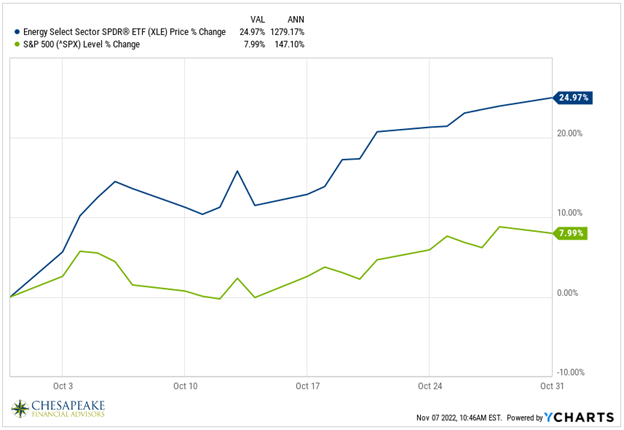

Sector Scorecard

All industry sectors notched gains in October, with gains mainly in Energy (24.97%) and Industrials (13.89%).

What Investors May Be Talking About in September

November will be a busy month for investors.

First, the market will be digesting another Fed 0.75% interest rate hike and the outcome of the midterm elections. Investors will also be getting updates on inflation and the labor market.

The Consumer Price Index is set for release on November 10th, and investors will be anxious to see if inflation is moderating. The Producer Price Index will be released on November 15th, providing insights into the cost pressures producers of goods and services face.

In addition, investors’ attention is expected to be focused on monthly employment reports and the weekly initial jobless claims. Trends in the jobs markets and wage growth will play a role in the Fed’s future decisions about interest rates. If we continue to see strong jobs market and wage growth, the Fed will continue to advance their fight to combat inflation.

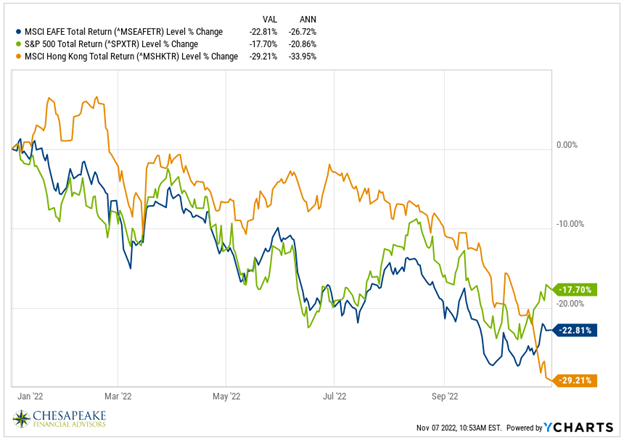

World Markets

Overseas markets rebounded in October, as political uncertainty in the UK started to get resolved and energy security in Europe improved. For the month, the MSCI EAFE Index was up 5.26%.

Pacific Rim markets were mixed. Hong Kong dropped 14.72% due to investor concerns following the meeting of China’s Communist Party and news of factory shutdowns due to Covid protocols.

Indicators

Gross Domestic Product (GDP)

The initial estimate of third-quarter GDP growth came in at an annualized rate of 2.6%, exceeding economists’ consensus of 2.3% estimate.

Employment

Employers added 263,000 jobs in September as the unemployment rate fell to 3.5%. Wage growth of 5% in September was below August’s gain of 5.2% and the labor force participation rate slipped to 62.3%.

Retail Sales

Consumer spending was flat in September compared to August, but spending was 8.2% higher than a year ago.

Industrial Production

Industrial production rose 0.4% in September, while capacity utilization increased to 80.3%. Capacity utilization was 0.7% above its long-term average.

Housing

Housing starts dropped 8.1% in September as higher mortgage rates tempered demand for new homes.

September’s existing home sales slipped 1.5% month-over-month while falling 23.8% year-over-year. It was the eighth consecutive month that sales declined.

New home sales fell 10.9% while posting a 17.6% decline from a year ago. The median sales price rose, though it remains below the record high of July.

Consumer Price Index (CPI)

Consumer prices increased 0.4% in September. The year-over-year increase was 8.2%. Core inflation (excluding energy and food) rose 0.6% in September and was higher by 6.6% from a year ago. The annual gain in core prices was the highest in 40 years.

Durable Goods Orders

Orders for long-lasting goods rose 0.4%. Civilian aircraft orders led to a six-month increase in durable goods orders in the last seven months.

The Fed

Minutes from September’s Federal Open Market Committee (FOMC) meeting reflected members’ concern over persistently high inflation. Jerome Powell’s remarks last week showed no signs of slowing down rate increases until inflation is where they want it to be, ~2.5%.

The FOMC members agreed that additional rate hikes would keep inflation from becoming embedded into the economic landscape and help prevent greater economic pain in the long run. Several members also expressed worries that overdoing such rate increases might raise the risk of economic and financial market volatility which we believe we will see for many months to come.

ONE ADVISOR | TWICE THE ADVICETM

Give us a call at (410) 823-5442 or email [email protected].

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf